Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com

Office Hours 10:00 am – 6: 00 pm , Mon-Fri

Binarysoft is Authorised Tally Sales & Implementation Partner in India

+91 742 877 9101 or E-mail: tally@binarysoft.com

Office Hours 10:00 am – 6: 00 pm , Mon-Fri

Published on: 16-03-2022

The e-invoicing system, which is already being implemented for bigger businesses and to be implemented for 20 crores and above businesses from 1st April 2022, is primarily designed with 2 key aspects. First is the adoption of a standard for the invoice, which will enable standardization and swift data exchange across the different systems. The next being the registering the invoice with Government, through Invoice Registration Portal (IRP) which will ensure the authenticity of invoices

At a larger picture, it is believed that e-invoicing will play a key role to ensure the interoperability of the data with various systems alongside curbs tax evasion.

With the implementation of e-invoicing, the GST system shall be able to validate all the B2B transactions electronically and pre-populate the same in taxpayer’s GST return forms and e-way bill, as per the e-invoice details uploaded by the taxpayer.

Before getting into the process to generate an e-invoice, it is important to note that there has been a major misconception surrounding e-invoice generation. The famous misconception here is that the businesses can generate the invoices centrally through the governments portal.

That’s not true! e-invoice does not mean the generation of invoices from a central portal of the tax department. Instead, an e-invoice requires a business to generate the invoice in the prescribed format using the accounting software and upload it to the portal designed to authenticate such invoices.

Let’s now understand the steps to generate the e-invoice

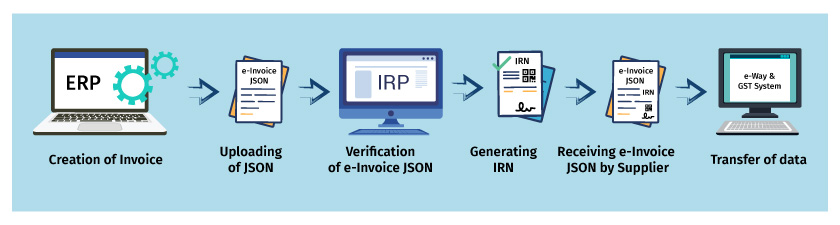

As illustrated above, the following are the detailed steps to generate an e-invoice in GST.

Step -1 Creation of e-invoice JSON: The first step is to create the invoice JSON using the accounting software as per the prescribed format. The taxpayer can generate it either using ERP software or using the offline utility provided by the government.

Step -2 Uploading of JSON: In this step, the invoice JSON for every B2B invoice generated using accounting software or any other utilities are uploaded to the IRP system. If the ERP software is integrated with IRP via GSP, the upload of the JSON file will be automated, meaning the system sends the required details directly to the IRP portal.

Step-3 Verification of e-invoice JSON: In this step, the IRP system validates the e-invoice JSON and checks the central registry of GST for any duplication.

Step-4 Generating invoice reference number (IRN): After successful validation of e-invoice JSON, the IRP system will generate IRN. IRN generated will be a unique number of each invoice for the entire financial year. Also, the e-invoice JSON will be updated with a digital signature along with a QR code.

Step-5: Receiving digitally singed e-invoice JSON: Here, the digitally signed e-invoice JSON along with QR code is sent to the supplier. The IRN and QR code will be printed on the invoice before issuing it to the buyer. In case of an integrated environment of ERP and IRP via GSP, the software will automatically fetch and print such details

Step-6 Transfer of data to e-way bill system and GST system: The invoice JSON data uploaded, will be shared with the e- way bill and GST system, for preparing e - waybills and for auto-population of GST return.

Got questions on e-invoice? Read our article ‘What is e-invoicing’ to know and understand the fundamentals of the e-invoicing concept.

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 6750 + 18% GST (₹ 1215)

Applicable for CAs / Firms Using GOLD (Multi User ) Only

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 12150

+ 18% GST (₹ 2187)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 13500 + 18% GST (₹ 2430)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 24300

+ 18% GST (₹ 4374)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 4500 + 18% GST (₹ 810)

Single User Edition For Standalone PCs ( Not applicable for Rental License )

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!

₹ 8100

+ 18% GST (₹ 1458)

Tally On Cloud ( Per User Annual)

Now access Tally Prime anytime from anywhere – Just Deploy your Tally License and Tally Data on our Cloud Solution.₹ 7000 + 18% GST (₹ 1260)

Unlimited Multi-User Edition

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 67500 + 18% GST (₹ 12150)

Unlimited Multi-User Edition For Multiple PCs on LAN Environment

Renew your license now and upgrade from Tally ERP 9 to Tally Prime for Free!₹ 45000 + 18% GST (₹ 8100)

Single User Edition For Standalone PCs

For EMI options, please Call: +91 742 877 9101 or E-mail: tally@binarysoft.com (10:00 am – 6: 00 pm , Mon-Fri)₹ 22500 + 18% GST (₹ 4050)

(Per User/One Year)

TallyPrime latest release pre-installed₹ 7200 + 18% GST (₹ 1296)

(Two Users/One Year)

TallyPrime latest release pre-installed₹ 14400 + 18% GST (₹ 2592)

(Four Users/One Year)

TallyPrime latest release pre-installed₹ 21600 + 18% GST (₹ 3888)

(Eight Users/One Year )

TallyPrime latest release pre-installed₹ 43200 + 18% GST (₹ 7776)

(Twelve Users/One Year)

TallyPrime latest release pre-installed₹ 64800 + 18% GST (₹ 11664)

(Sixteen Users/One Year)

TallyPrime latest release pre-installed₹ 86400 + 18% GST (₹ 15552)